Heading: BTC Volatility Continues as Price Hits Fresh All-Time Highs

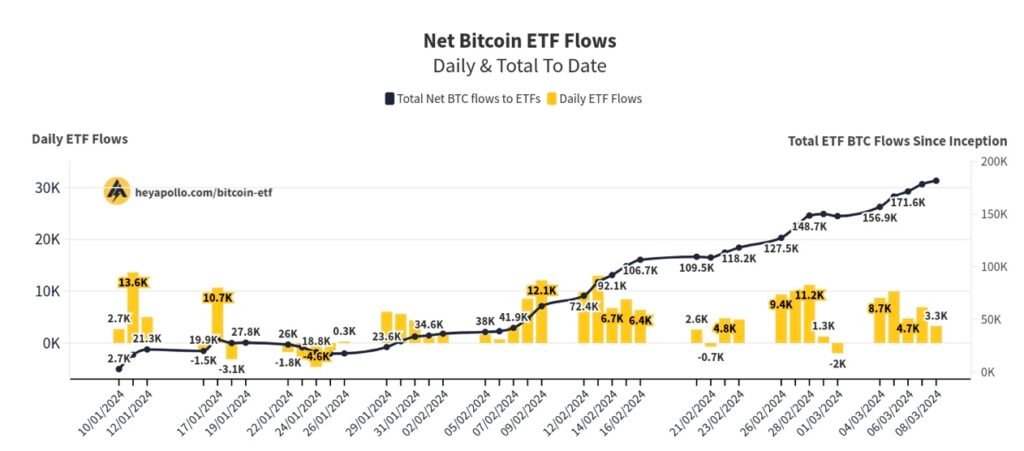

Bitcoin (BTC) kicks off the new week with a wobble, reaching a high of $72,012 and securing its highest-ever weekly close. Despite hitting fresh all-time highs, the digital currency faces challenges in breaking even higher. The battle for price discovery remains intense as selling pressure at key psychological levels clashes with the persistent demand from spot exchange-traded funds (ETFs).

Heading: ETF Buying Influences BTC Price Momentum

ETF buying has become a significant factor impacting Bitcoin’s price trajectory, surprising many market participants. Longtime bulls now reconsider their BTC/USD forecasts, with $1 million seen as a conservative estimate in the long term. However, some analysts caution that the current bull run could lead to a macro price top sooner than expected.

Heading: US Macro Data and Federal Reserve’s Interest Rate Decision

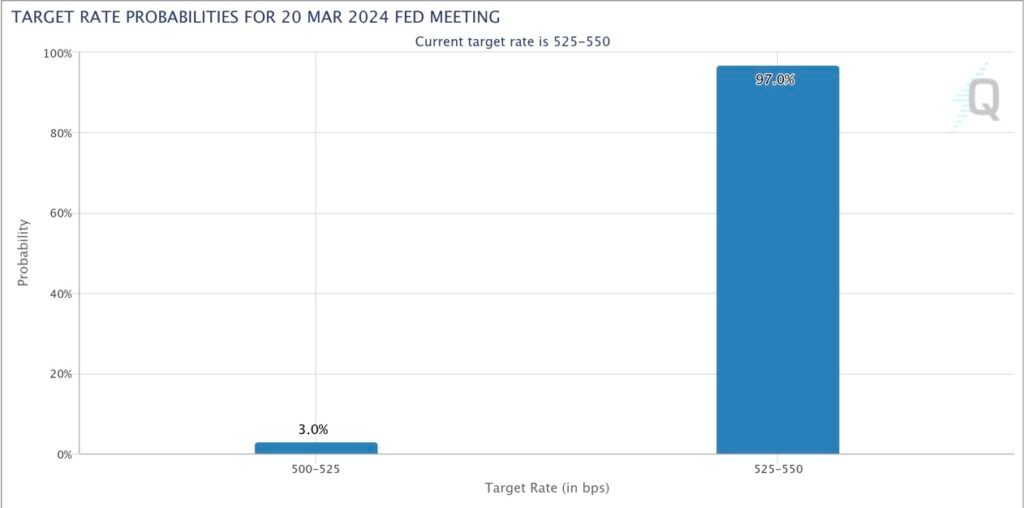

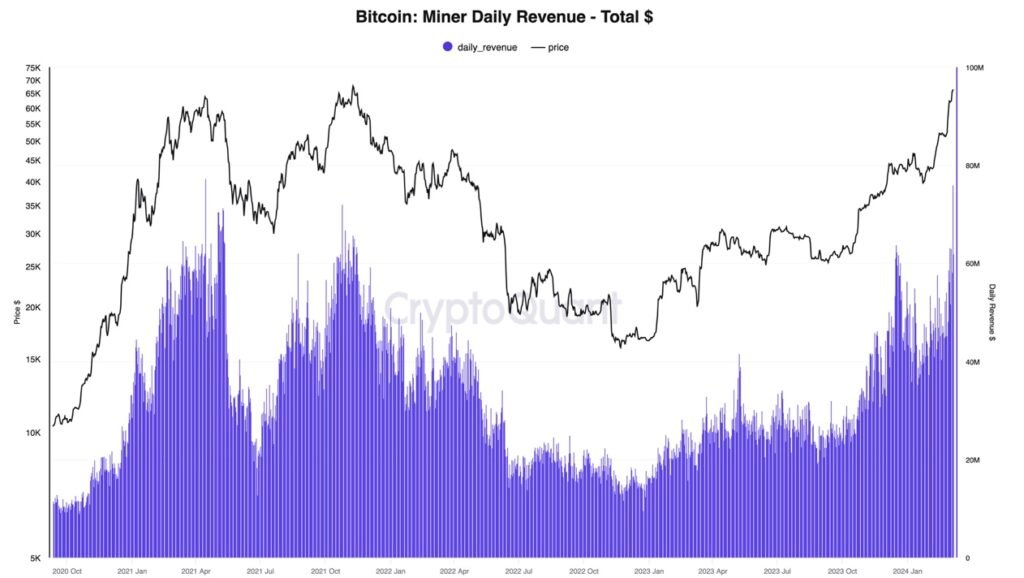

As Bitcoin stands at a crossroads, miners are seizing the opportunity to lock in profits before the upcoming block subsidy halving in April. Meanwhile, United States macroeconomic data release will set the tone for the Federal Reserve’s decision on interest rates. How these developments will influence Bitcoin’s price volatility remains to be seen.

Heading: Record Weekly Highs and Price Discovery

Bitcoin experienced significant price volatility leading up to the highest weekly close in history at $69,000. Despite a brief decline, a bounce back propelled Bitcoin to new all-time highs during the Asia trading session on March 11. Traders are closely monitoring key price levels to sustain the uptrend and anticipate potential market movements.

Heading: Impact of US CPI and Fed Rate Cut Expectations

The focus shifts to the Consumer Price Index (CPI) release for February on March 12, which could affect short-term trading across various asset classes, including Bitcoin. Speculation surrounding inflation and Fed policy uncertainty continues to influence market sentiment. The upcoming Fed meeting will rely heavily on CPI figures and other data points for guidance.

Heading: ETF Bitcoin Buyer Pressure and Institutional Optimism

Spot ETFs play a pivotal role in Bitcoin’s price transformation, with many anticipating continued institutional interest in the digital asset. Industry insiders foresee major players adding BTC exposure in the near future, driving price momentum. Amidst growing optimism, the market awaits significant flows from institutional investors in the second quarter of 2024.

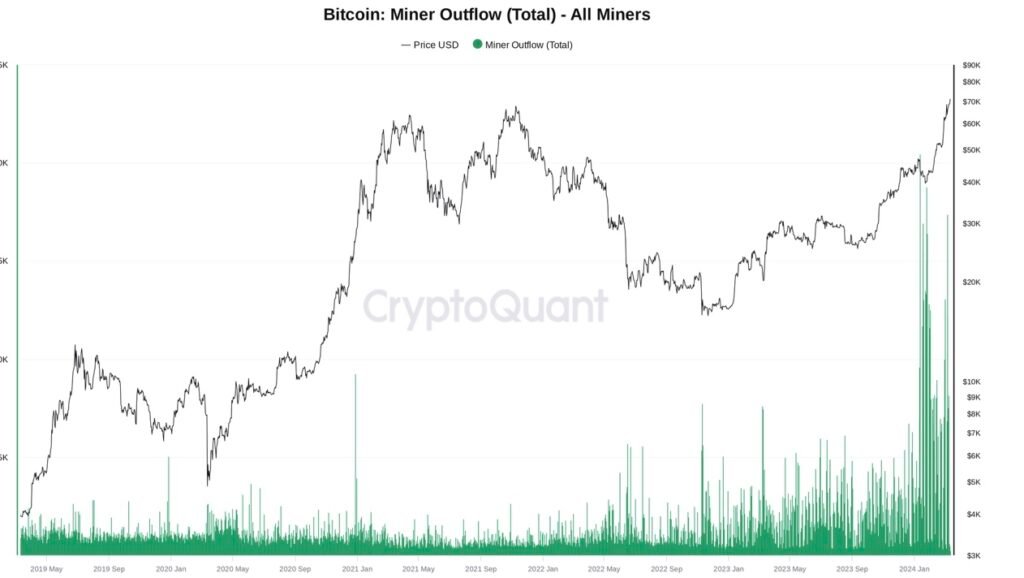

Heading: Miner Outflows and Puell Multiple Surge

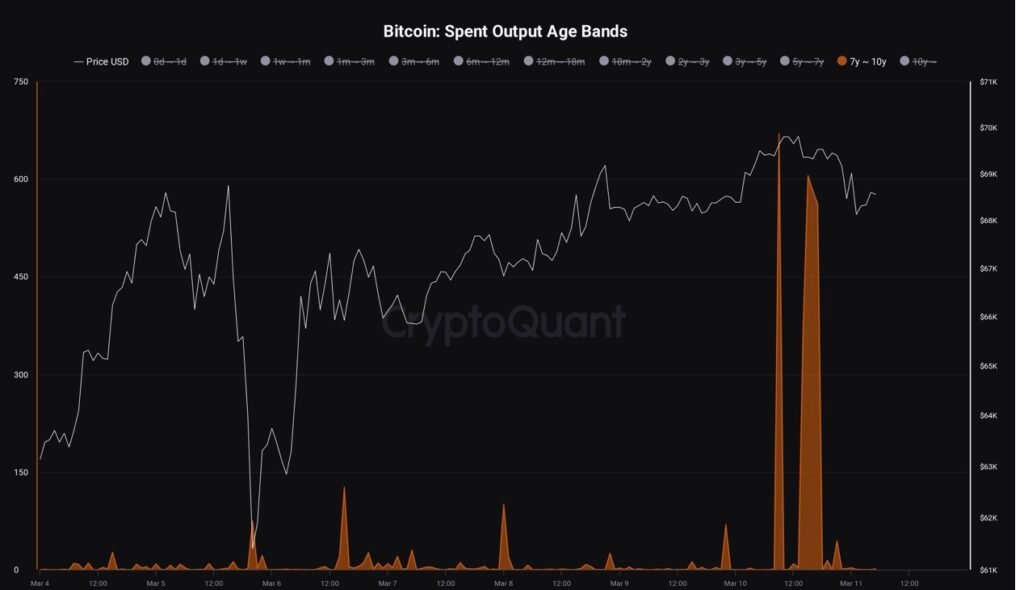

Miners are capitalizing on Bitcoin’s price surge ahead of the next halving, leading to increased selling activity and record-high daily revenues. The Puell Multiple, an indicator of coin issuance value against the yearly moving average, nears six-year highs, signaling potential market tops. However, long-term holders remain steadfast in holding onto their assets, showing resistance to selling despite price appreciation.

Heading: Bitcoin Hodlers’ Resilience Amid Price Discovery

Seasoned Bitcoin hodlers continue to hold onto their assets even as BTC price hits new milestones. Glassnode data reveals that long-term holders are not transferring large volumes, suggesting confidence in Bitcoin’s long-term growth potential. Net unrealized profit/loss for LTHs remains strong, indicating that Bitcoin’s most committed holders are yet to reach levels indicative of market peaks.

In conclusion, Bitcoin’s price surpassing $70K signifies a significant milestone in its ongoing price discovery journey. As market dynamics continue to evolve, traders and investors should stay informed about the developments shaping Bitcoin’s future trajectory.

How can I create a account on Cryptosroom ?

We made it easy for you with video tutorial how to sign up and update your profile edit cover images . click the link given below to watch the tutorial.

How to post article about my project in Cryptosroom ?

Email your query to us we are happy to serve you 24/7 , Contact Us .